MTN, a leading mobile carrier in South Africa, has demonstrated the power of premium partnerships by securing the top spot in our top 10 services on South African networks. In just one month, MTN’s ad buying power has placed Disney + in prime position with a 78% market share of the top mVAS services advertised via Google.

The Disney+ Partnership

In August 2023, MTN and Disney+ announced their partnership, launching a limited mobile plan priced at R49 per month. This partnership not only provided MTN subscribers with access to the vast Disney+ library but also included the offer of 500MB of free streaming data each month for subscribers who added Disney+ to their monthly bill or paid for it with airtime. To cater to the diverse needs of its customer base, an additional option, the Disney+ mobile “entertainment pass,” was introduced at R59 per month, offering 2GB of streaming data.

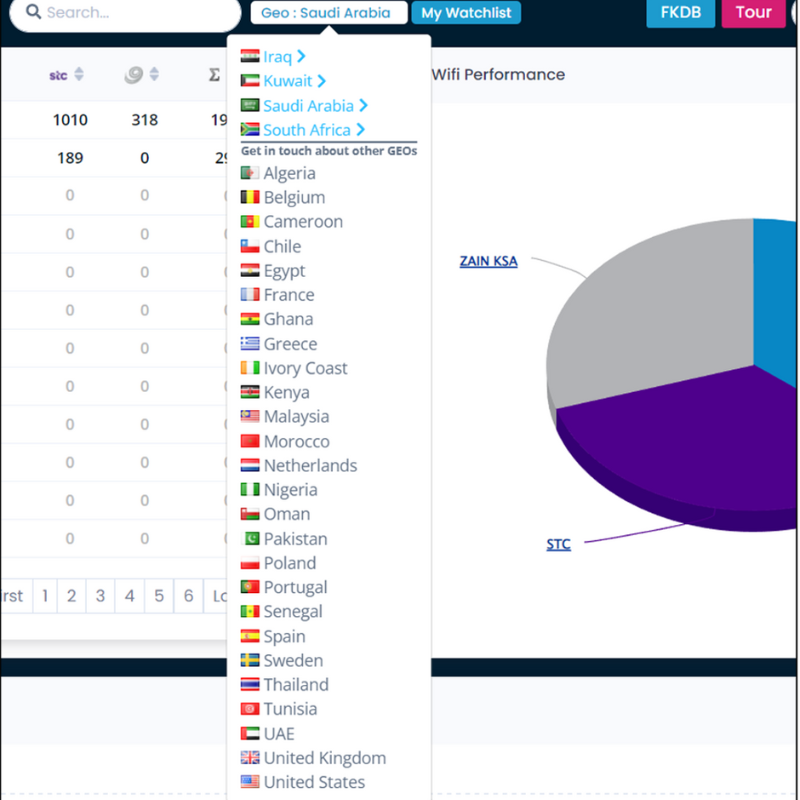

Over the past month, MCP TRENDS, our ad monitoring platform, has been closely monitoring Disney mVAS’ rise in South Africa. In the first week of October there was no sign of Disney+ in our top 10 for South Africa, but by the second week the brand had 8% of the top 10 services, overtook all other services in week three with 62%, and by the end of October Disney+, with the help of MTN’s Google ad buying, had consolidated its position with 78%. This growth reflects the success of MTN’s strategic approach in collaboration with Disney+.

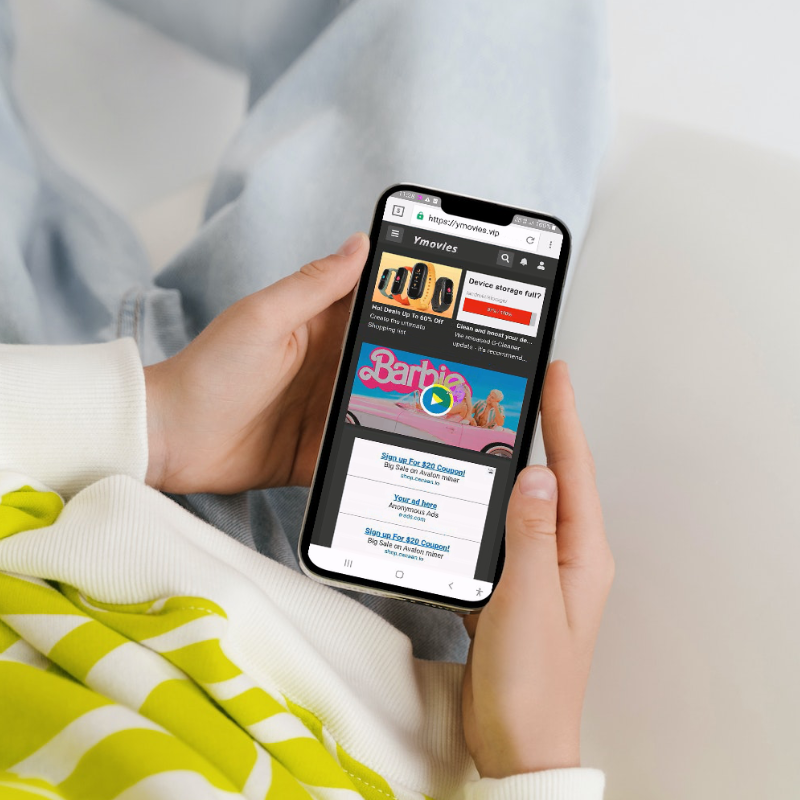

Disney+’s success is not an isolated case but rather a part of a growing trend in the mVAS sector. Mobile carriers are increasingly partnering up with premium brands like Disney+ and strategically using Google Ad space to dominate the market. This trend is indicative of the shift towards providing comprehensive entertainment experiences that go beyond traditional mobile services, capturing the imagination of subscribers.

MCP TRENDS: Your Gateway to Analysing Market Dynamics

As this trend continues to evolve, marketers need to monitor their competitors’ ad campaigns and use this information to benchmark your own, improve performance, and identify opportunities to stay ahead in an increasingly competitive landscape.

MCP TRENDS provides the most comprehensive market intelligence in the mVAS/DCB space. If you have an MCP TRENDS account for the South African market, you can directly monitor MTN’s campaigns and gain insights into the entire customer journey including banners, landing pages, and payment pages, as well as monitoring other players in the market.

Furthermore, by combining this market intel with Google Ad’s Advertising Research Positions report, you can gain a deeper understanding of the customer journey, by engaging in organic research to glean valuable insights into your competitors’ strategies.

If you would like to find out more about the South African mVAS/DCB market, or other markets in Africa, MCP Insight will be at Africa Com on 14-16 November. Book a meeting here to find out more >