The holiday season is a time of joy, celebration, and gift-giving, with many consumers eager to treat themselves and their loved ones to new mobile digital experiences or to grab an attractive promotional offer. This is a boom for content service providers (CSPs) and merchants offering a wide range of services from video streaming platforms to iGaming. However, the festive period also serves as a breeding ground for fraudsters and scammers, who prey on the increased consumer activity to exploit unsuspecting individuals.

‘Tis the Season of Deception: How Consumers Can Be Duped

As the demand for mVAS (mobile value-added services) and DCB (direct carrier billing) payments surge, fraudsters employ various tactics to lure consumers into their traps. Misleading and deceptive advertisements are a common ploy, often featuring false endorsements or exaggerated claims about the value or benefits of a service. In some cases, these fraudulent activities specifically target children, using enticing visuals and captivating language to encourage them to make unauthorised purchases.

Consumers may find themselves unwittingly subscribed to services they never wanted or fall victim to tactics that trick them into downloading malware onto their phones. The repercussions are far-reaching, impacting both the inexperienced and financially stressed, especially those who are under increased pressure over Christmas. This exploitation not only damages consumers but erodes trust in the mVAS/DCB space.

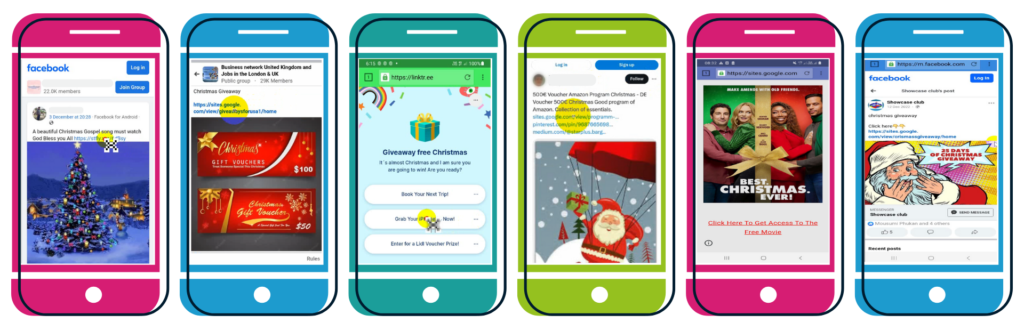

In just two days MCP found over 100 non-compliant or fraudulent advertisements pushing Christmas giveaways. It’s clearly a lucrative business, but one that has a serious impact on the integrity of the entire industry.

Here are just a few of examples of misleading Christmas ads we’ve discovered recently:

Types of Misleading mVAS Advertisements:

- Exaggerated claims about service benefits or features: Promises of unlimited access or significant discounts may not be accurately reflected in the actual service.

- Illegitimate endorsements from celebrities or influencers: Be wary of advertisements that falsely claim to have the backing of popular figures.

- Manipulation of price tags or subscription models: Look out for hidden charges, confusing pricing structures, or pressure-induced purchases.

- Giveaways: Watch out for ads that promise instant cash if you click on a link.

Once consumers are lured in by misleading advertising, fraudsters employ various methods to enrol them in unwanted services or download malware onto their devices. Phishing scams, redirects to fake websites, and hidden subscription opt-ins are common techniques used to trick unsuspecting users. In some instances, consumers may be subjected to recurring charges for services they never authorised, leading to financial strain and frustration.

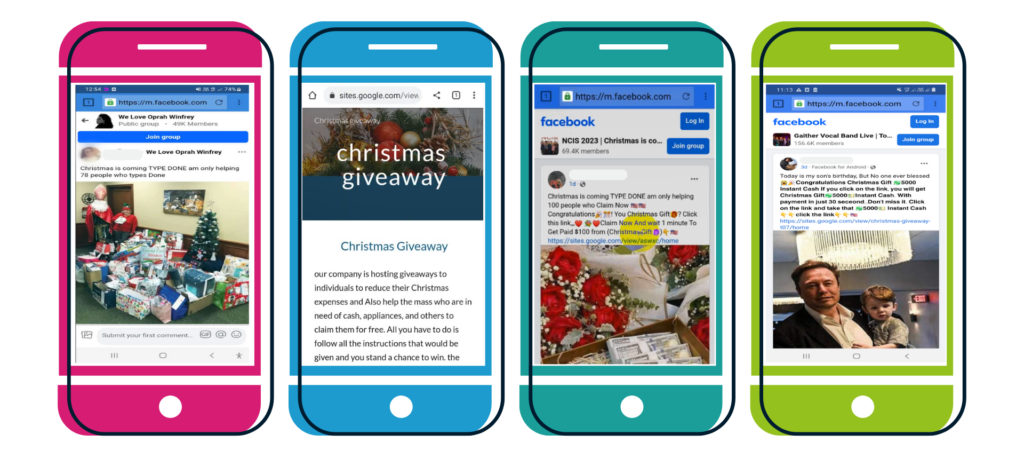

Worryingly, we’ve noticed a growing trend of targeting vulnerable individuals. While many Christmas giveaways promise iPhones and Amazon vouchers are positioned as an extra bonus or prize, some ads are deliberately targeting people with financial difficulties.

We found these Christmas giveaways below, which appear to be altruistic initiatives to help reduce the cost of Christmas and help people in need. Clicking on one of these adverts takes consumers to a landing page where they’re asked to enter their mobile number to either receive instant cash or be entered into a draw. Sadly, instead of getting cash or a genuine chance to win, their mobile phone bill is charged or the link downloads malware.

As consumers fall prey to fraudulent activities, the aftermath is felt by reputable players in the mVAS/DCB ecosystem. Complaints surge, consumer trust diminishes, and regulators may step in, threatening fines and penalties.

mVAS Advertising Compliance Requirements

mVAS advertising compliance requirements are designed to protect consumers and the mVAS/DCB value chain. In markets, like the UK, self-regulation has been proven to create a more sustainable and resilient business environment, fostering trust and transparency.

To empower industry stakeholders, we’ve created an infographic offering a snapshot of essential compliance requirements. Whether you’re a seasoned professional or new to the mVAS/DCB space, this resource will help you navigate the regulatory environment.

For a full size version of this infographic, please click here >

In the face of rising fraud, robust tools to monitor mVAS ads and flows in order to identify non-compliant and fraudulent activities are essential. Whether you’re a Mobile Network Operator, Payment Aggregator, or Content Service Provider, due diligence and risk control are paramount to safeguard your business, and the wider industry.

If you’d like to discuss best practices and explore solutions, please get in touch.

This holiday season let’s ensure it’s a wonderful time of year for everyone, apart from the fraudsters!