As a mobile operator, you’re always on the lookout for new ways to enhance the user experience and generate revenue. One option that has gained popularity in recent years is Direct Carrier Billing (DCB). This mobile payment method offers a range of benefits for both users and mobile operators, making it an attractive option for businesses looking to simplify their payment process and improve customer satisfaction.

Direct Carrier Billing – a seamless user experience

One of the key advantages of Direct Carrier Billing is an improved user experience. By eliminating the need for payment card information (credit or debit), users can make purchases quickly and easily, without having to navigate through complicated payment forms. This can be especially important for mobile users, who may be using their device on-the-go and don’t want to spend time entering their payment information. With DCB, the payment process is seamless and integrated into the mobile experience, making it easier and more convenient for your users to make purchases.

Greater security compared to payment cards

Another benefit of Direct Carrier Billing is its security features. With DCB users do not need to enter their credit card information or other sensitive data to make a purchase. Instead, the transaction is completed by simply entering the mobile phone number and confirming the payment, which is then added to the user’s monthly mobile phone bill. This not only reduces the risk of fraud but also provides a layer of anonymity that can be attractive to users who are wary of sharing their personal information online.

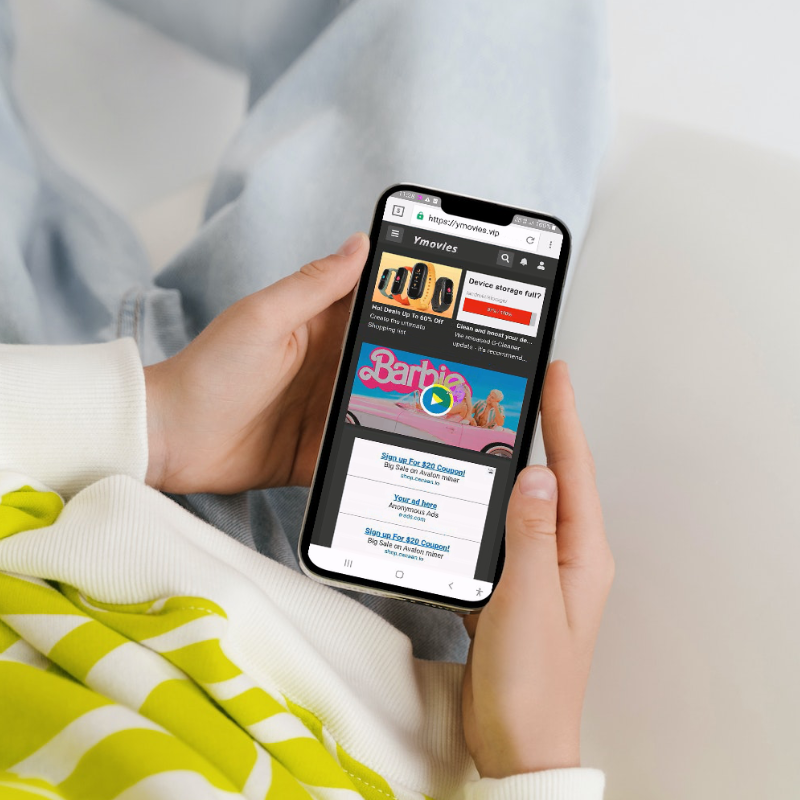

Of course, fraud is an issue when any financial transaction is involved. Cybercriminals are always on the lookout for opportunities to exploit vulnerabilities. However, mobile billing anti-fraud solutions can be deployed to protect the mobile billing payment page and block suspicious and fraudulent transactions; giving you and your customers reassurance that everything is being done to protect their accounts.

Increases financial inclusion for mobile users

Globally 1.4 billion people are unbanked, without access to a financial account. This means they don’t have access to traditional payment methods such as credit and debit cards, and therefore may struggle to pay for many digital services and products. Direct Carrier Billing removes this barrier by allowing users to pay for goods and services via their mobile phone bill or pre-paid SIM. This makes it easier for users with limited access to credit or bank accounts to make online purchases, opening up a new world of opportunities for digital content and services.

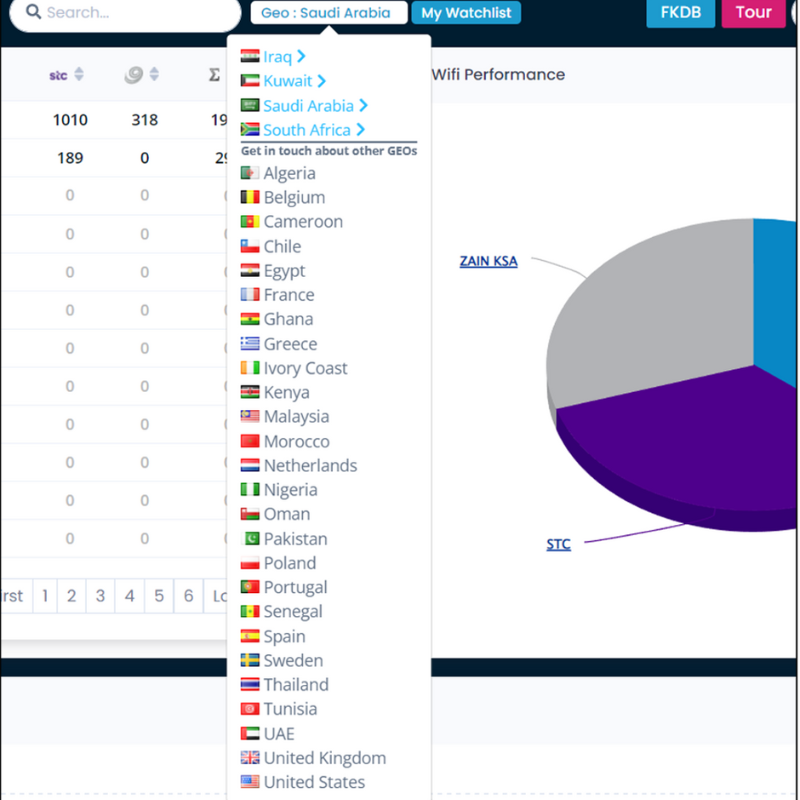

This is advantageous for merchants looking to expand into markets where a significant percentage of the population remains unbanked, such as in Iraq where only 22.7% of the population have a bank account compared to 103.0% who have a mobile phone connection and 75.0% who use the internet.

For mobile operators, facilitating DCB transactions helps them provide additional services for their unbanked customers, and increases customer satisfaction and retention.

Higher conversion rates

In addition to increasing financial inclusion, Direct Carrier Billing can also lead to increased conversions. DCB transactions involve minimal clicks and form filling. Whereas with traditional payment methods, users may abandon their cart if they encounter any difficulties during the payment process. This can be due to a variety of factors, such as complicated checkout procedures or concerns about security.

With Direct Carrier Billing the payment process is streamlined and easy to use, reducing the likelihood of cart abandonment and increasing the chances of a successful conversion.

New revenue streams

DCB allows mobile operators to earn a commission on transactions made by your customers. This commission can be a percentage of the transaction value or a fixed fee per transaction. As more customers use this method to make purchases, you will also benefit from increased transaction volumes. This can result in higher revenue from transaction fees and potentially lead to negotiating higher commission rates with merchants due to increased volume.

By developing stronger partnerships with merchants by facilitating DCB as a payment option, there may also be increased revenue-sharing opportunities and deeper integration with merchant services.

Increase customer retention

Finally, Direct Carrier Billing helps make customers ‘sticky’. By providing an easy-to-use payment method that is integrated with the user’s mobile phone bill, you can increase customer loyalty and reduce churn. This can be especially important in an industry where customer retention is a key factor in generating revenue.

DCB can also provide a platform for cross-promotion of other services, such as loyalty programs, value-added services, and promotions, which can result in increased sales revenue as well as increased customer retention.

So, if you’re looking to enhance the user experience and generate revenue, Direct Carrier Billing can provide your customers with additional services and products, with a seamless, convenient and secure payment method, which keeps them ‘sticky’.