As direct carrier billing (DCB) becomes an increasingly mainstream alternative payment method globally, it’s also becoming more critical that the necessary controls and standards are in place to protect your customers and DCB business.

Robust Due Diligence and Risk Control (DDRC) can help mobile carriers build a profitable and sustainable DCB business by:

- Avoiding brand damage that might result from being seen as an accessory to a scam or major compliance incident

- Preventing market closure or unnecessary trading restrictions

- Avoiding sanctions and significant fines

- Fostering effective self-regulation to cut off the bad practice

- Building trust with customers and reducing complaints

DDRC best practice and the benefits of self-regulation

In the UK, the Phone-Paid Service Authority (PSA) tightly regulates direct carrier billing. Its guidance on DDRC is increasingly being adopted by markets outside of the UK and organisations like the GSM Association, Mobile World Congress and the International Telecommunications Union.

While some may view the UK’s regulatory landscape as excessively stringent, it has effectively made the regulator’s job redundant. Therefore, self-regulation by adopting best practices like the PSA’s DDRC standard could prevent scrutiny by regulators in other markets – especially as the main driver for regulation is high volumes of customer complaints.

This condensed version highlights key elements of their guidance:

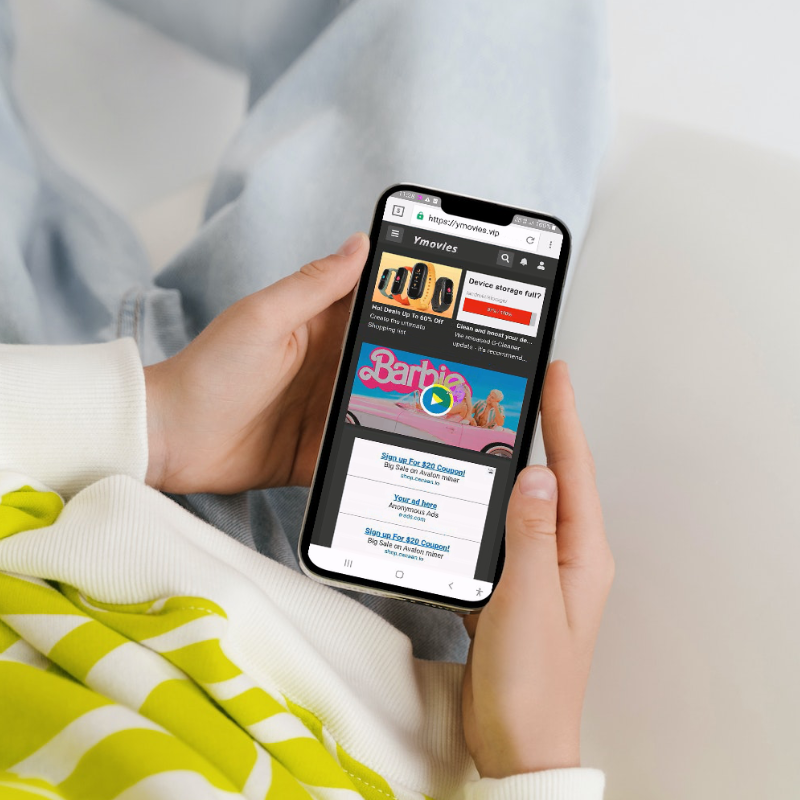

- Customer Verification: PSA emphasises the importance of thorough customer verification processes to ensure the legitimacy of DCB transactions. Carriers should implement robust authentication measures to prevent unauthorised charges and protect customer interests.

- Merchant Due Diligence: Carriers must conduct comprehensive due diligence on merchants and service providers before engaging in business partnerships. This includes evaluating their reputation, financial stability and compliance with regulatory requirements.

- Transparency and Consent: PSA stress the significance of transparent pricing and obtaining customer consent for each billing transaction. Carriers should ensure customers have a clear understanding of the services provided, associated costs, and the billing process.

- Customer Care and Complaint Handling: Effective complaint handling mechanisms are crucial to addressing customer concerns promptly and resolving disputes. Carriers should establish procedures for handling complaints, including investigation, resolution and appropriate compensation if necessary.

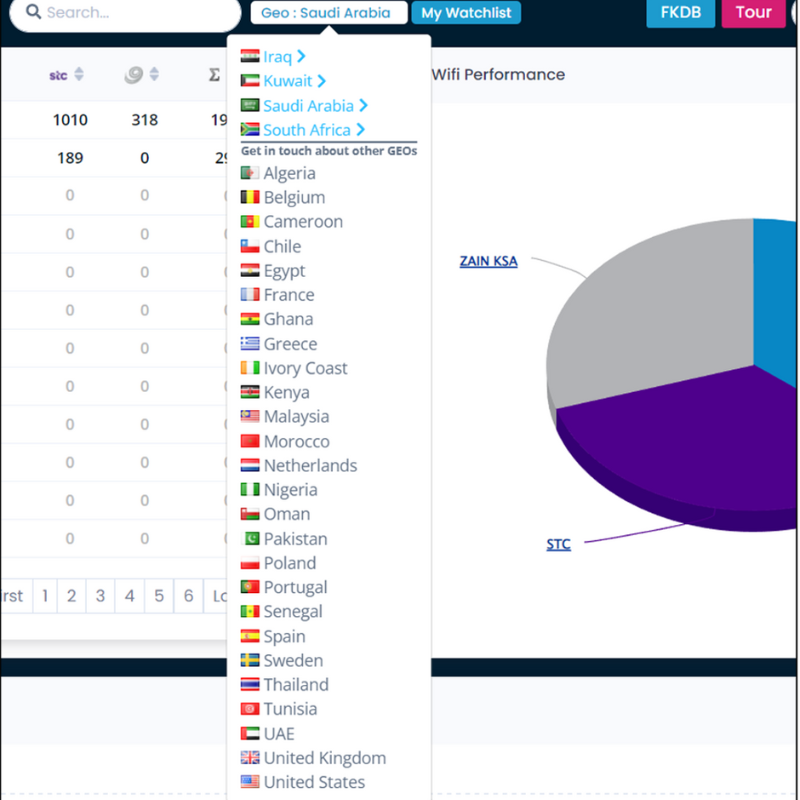

- Monitoring and Reporting: PSA recommends implementing robust monitoring and reporting systems to detect suspicious activities, identify potential fraud, and ensure compliance. These systems should also be auditable, providing carriers with a tamperproof platform for providing evidence of compliance.

- Risk Mitigation: Carriers should establish risk mitigation strategies, such as transaction limits, fraud prevention measures, and continuous monitoring of billing activities. These measures help minimise potential risks and protect both carriers and customers.

- Training and Awareness: PSA emphasise the importance of ongoing training and awareness programs to keep carrier staff updated on industry regulations, fraud prevention techniques, and best practices for DDRC.

Please note that this is a condensed version of the DDRC Standard and should not be considered a substitute for the complete guidance provided by the Phone-Paid Service Authority. It is advisable to refer to the original documentation for a comprehensive understanding and implementation of DDRC practices in the mobile carrier industry.

MCP has had extensive experience working with UK mobile carriers to implement robust DDRC processes. If you would like to learn more about this work and discuss how you can apply DDRC best practices in your organisation, please get in touch.