Why waiting for issues to escalate puts unnecessary pressure on regulators and markets alike.

In many global markets, across mobile content and payments, complaint volumes are rising. For regulators, that often means more investigations, more pressure, and a louder call to act. But behind every spike in complaints is a deeper story – one that often begins long before a consumer decides to report a problem.

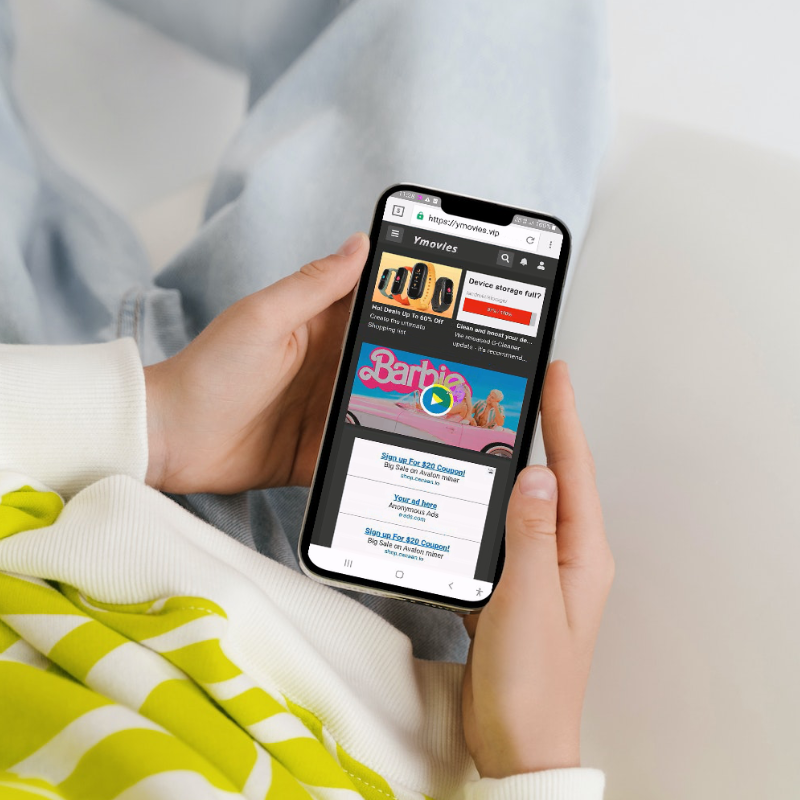

Whether it’s a misleading promotion, a confusing payment flow, or an aggressive subscription tactic, the harm to the consumer usually happens well before a formal complaint is made. And by the time those complaints reach critical mass, regulators may find themselves forced into fast, broad enforcement – even if the problem stems from just a few bad actors.

The Problem with Reactive Oversight

No regulator wants to slow digital innovation. But without earlier visibility into what’s happening on the ground, it becomes difficult to separate compliant providers from those cutting corners. The result? Blanket interventions – like blocking affiliate traffic or adding friction to billing journeys – that protect consumers in the short term, but risk harming the market in the long run.

That’s not a failure of regulation. It’s a failure of insight.

When complaints are the first clear signal of risk, regulators are already on the back foot.

A Smarter Way to Stay Ahead

What if complaints weren’t the starting point for action – but the final fallback?

What if regulators could access earlier signals, spot trends before they scale, and focus their efforts where they’re most needed?

That’s not a theoretical future. In some markets, it’s already happening.

Modern oversight doesn’t mean more regulation. It means better visibility. It means being able to protect consumers earlier – and intervene proportionately when necessary.

How We Can Help

At MCP Insight, we sit in a unique position within the mobile content and payments ecosystem. We’re not a content service provider or payment aggregator – but we work closely with both. Our role is to monitor content flows, advertising practices, and payment journeys across global markets. Every day, we review thousands of service journeys, block fraudulent activities, investigate anomalies, and flag issues before they lead to complaints or regulatory escalation.

We’ve seen what good looks like. And we’ve also seen how early detection can prevent reputational damage, reduce consumer harm, and avoid the need for disruptive enforcement.

This gives us a broad, real-world view of how and where risks emerge – and what regulators can do to get ahead of them, without adding complexity or cost to their operations.

Join the conversation

If you’re exploring how to strengthen your oversight model without increasing operational burden, we are hosting a webinar – Collaboration: A Proactive Approach to Consumer Protection in DCB Worldwide. The session will explore how regulators in high-growth regions are using data-driven insight and smarter monitoring tools to reduce complaints, target risk earlier, and support sustainable market growth.