Why day-to-day visibility is key to supporting consumer protection and digital growth

Digital content and mobile payments are evolving at pace. New services launch daily. Marketing tactics change in real time. Fraud threats emerge, adapt and resurface. For regulators, the challenge isn’t just keeping up – it’s making sure oversight continues to protect consumers without slowing the market.

That matters, because mobile value-added services (mVAS) represent far more than just entertainment. They’re a gateway to digital access for millions – offering consumers services that are useful, affordable, and increasingly integrated into everyday life. From elearning platforms and wellness tools to subscriptions for tangible goods and services, mVAS is becoming a core part of how people engage with the digital economy. It’s also a powerful engine for financial and digital inclusion, especially in mobile-first regions where traditional infrastructure is limited.

In short, this is a market worth protecting – not just from fraud, but from fragmentation, mistrust, and unnecessary disruption.

Preventing mVAS Market Disruption

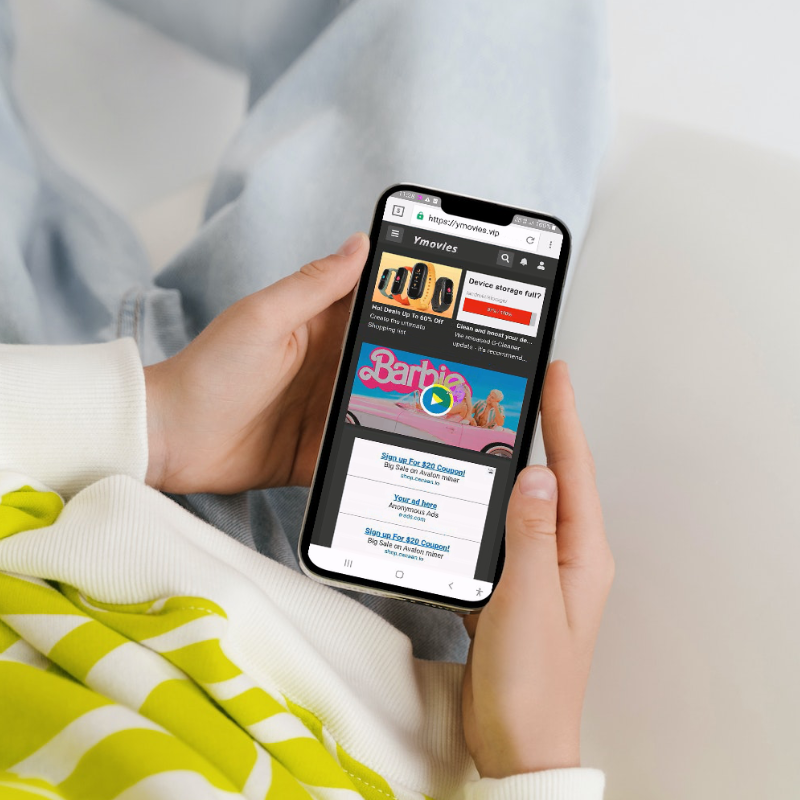

When something goes wrong in the customer journey – a misleading advert, a confusing payment flow, or a subscription they didn’t intend to activate – the harm often occurs long before the complaint. But for many regulators, complaints are still the first visible signal that something’s not right.

By the time those complaints build to a level that prompts investigation, it’s already reactive. That creates pressure – not just to respond quickly, but often to take broad action when precise targeting would be more effective.

With day-to-day insight into how services are being promoted, how payment journeys function, and how providers are adhering to market rules, regulators have a stronger foundation to act earlier and more proportionately – before user trust is damaged and complaint volumes spike.

That means:

- Intervening before complaint volumes reach a tipping point

- Identifying repeat issues across multiple services or campaigns

- Understanding which providers are operating with care, and which need closer scrutiny

The goal isn’t to restrict or disrupt – it’s to support a healthy, sustainable market where responsible services can thrive.

The Future of Regulatory Oversight is Focused

As digital markets continue to grow, so too does the need for clarity. Regulators don’t need to chase every service or scrutinise every advert – they need ways to prioritise their efforts, based on where the risk really lies.

That’s where smarter data and compliance platforms make the difference. They give regulators the confidence to focus, to act earlier, and to support clean market growth without increasing their burden.

Data-Driven Compliance Monitoring and Analysis

For over a decade, MCP Insight has been supporting regulators, mobile operators and other ecosystem stakeholders with visibility into the digital content and payments space. Through a combination of advertising monitoring, compliance analysis, and fraud detection, we help shine a light on where risks are emerging – and where services are doing things right.

Our expertise and platforms help regulators track trends, spot outliers, and target oversight efforts more effectively. That means fewer surprises, more strategic interventions, and better outcomes for consumers and compliant providers alike.

Join the conversation

We’re hosting a webinar – Collaboration: A Proactive Approach to Consumer Protection in DCB Worldwide – exploring how regulators are adapting to a more dynamic ecosystem with smarter oversight strategies.

We’ll be sharing practical insights on how advertising monitoring and compliance analysis are helping authorities reduce harm, build trust, and support a thriving digital economy.