What is your background in Mobile Billing/Vas Industry?

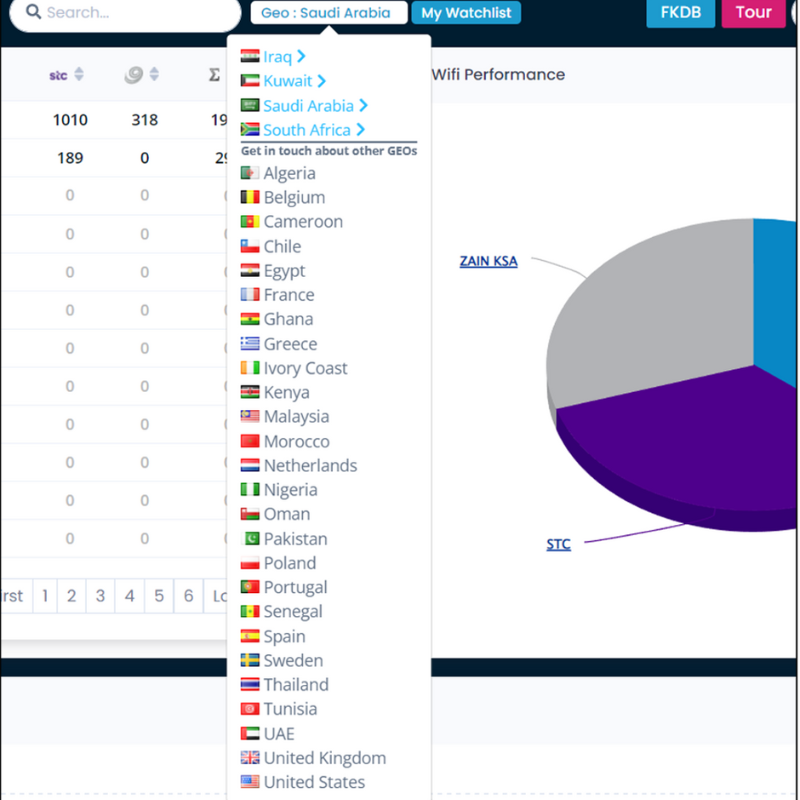

I’ve been in the VAS industry for 18 years, working for aggregators, content providers, and as a consultant. I have worked extensively in South Africa, but I have also worked in a few Sub-Saharan African markets, with a focus on Nigeria, Ghana, Kenya, and Uganda. I’ve seen the VAS industry from every angle, from selling connectivity to designing marketing campaigns for VAS/DCB services.

Where do you see the opportunities moving forward?

To a large degree the markets are very different based on geos, I think there is a lot of opportunities in markets in LATM and ASIA where the markets are slowly starting to open up to international players. Nigeria is finally opening up again and seems to be going in the right direction with MTN driving the opportunity. In the more mature markets branded content seems to be the play of the day with traditional CSPs partnering with the likes of Disney, NBA, WWE, FIFA, Sony, and Nintendo to sell their content in a space the latter having little experience in this market.

What are the major risks you foresee?

Fraud. I have lots of experience having used all the major anti-fraud tools available – but the tide continues unabated.

What does MCP do different to other anti-fraud suppliers to help in the battle?

From advertisement to subscription confirmation, you are fully protected. In my previous business, I used MCP scanning solution for years to focus on trends and traffic analysis. This, combined with their best-of-breed anti-fraud solution, provides a partner with a 360-degree plan to combat fraud.

Which territories are prone to the most fraudulent attacks and why?

The countries where there is not a unified, cohesive approach across the whole value chain – in particular at the top (Carriers) – to address this ongoing issue. Comparison between zero tolerance in North Europe and other parts of the world

Why is there such a discrepancy in approach?

Vas department, in relation to the carrier’s overall revenue, create a tiny % of value – but attract a disproportionate amount negative publicity. This is unacceptable to some carriers – but for others, whilst fraud is a priority, they also need to achieve budgets. So the comparative approach across different geos is driven by their own specific priorities.

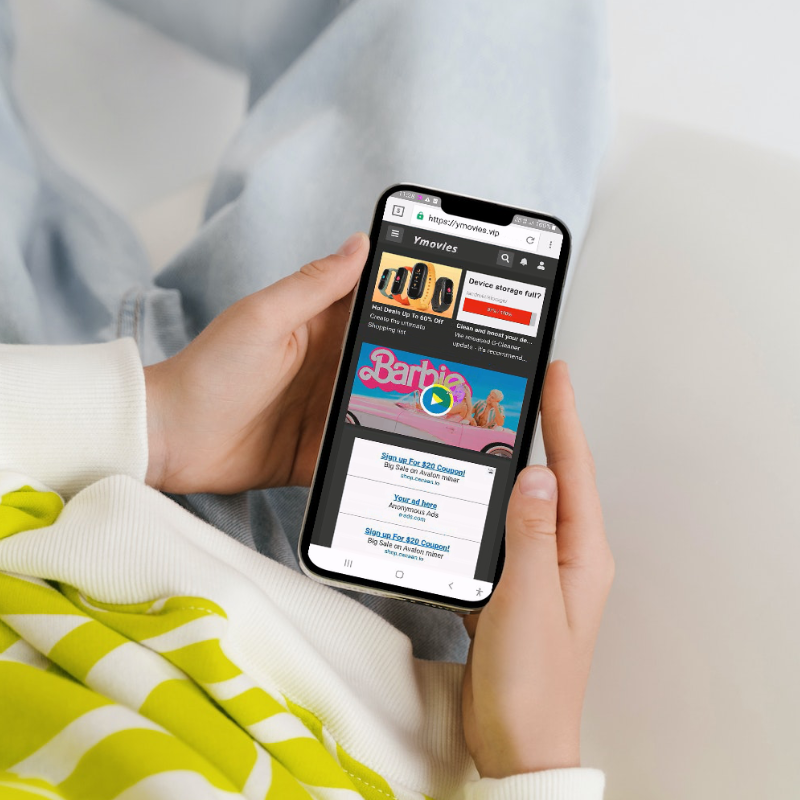

Can you give us a recent example of a new fraud type our readers need to look out for?

The nature of malicious applications and what we are seeing these apps do now in the market place is an intriguing observation. VAS models have traditionally used affiliate business with a focus on CPA as a quick and easy way to make money, and as more and more companies move to either anti-fraud partners or Google traffic, the Fraudsters (applications) are now more than ever looking at other elements of fraudulent activity on the device from mbanking, identity theft, and crypto to find variabilities. We install apps at MCP on a daily basis, and the consent that end-users give these apps is insane.

Do you ever see a day when Industry will defeat the fraudsters?

No, as in all industries, fraud is unavoidable. The most important thing is to ensure that we invest more in anti-fraud solutions while doing so in a consistent manner across the industry. Increasing the fraudsters’ efforts and ensuring that they will receive scant returns from the VAS industry, requiring them to divert their nefarious activity elsewhere