Direct carrier billing (DCB) is becoming increasingly mainstream worldwide, presenting both opportunities and challenges for payment aggregators. As they strive to balance the demands of CSPs, mobile network operators (MNOs), and regulators in different markets, ensuring compliance while driving sustainable growth has never been more critical. We sat down with Kev Dawson, Director at MCP Insight and a seasoned expert in the DCB space, to discuss the key trends, challenges, and best practices for payment aggregators in today’s complex environment.

Dawson’s journey through the carrier billing industry has provided him with a unique perspective. Having served as CEO of Dynamic Mobile Billing, he understands the intricacies of working across the full value chain. “That role really required good judgement, an understanding of expectations from different partners, and an ability to relay often quite complex practices and mandates in a way that could be understood and adopted across the board,” Dawson reflects. Now, having joined compliance and fraud experts MCP Insight, his experience has made him keenly aware of the challenges aggregators face as they navigate an increasingly complicated landscape.

The Evolving Carrier Billing Market

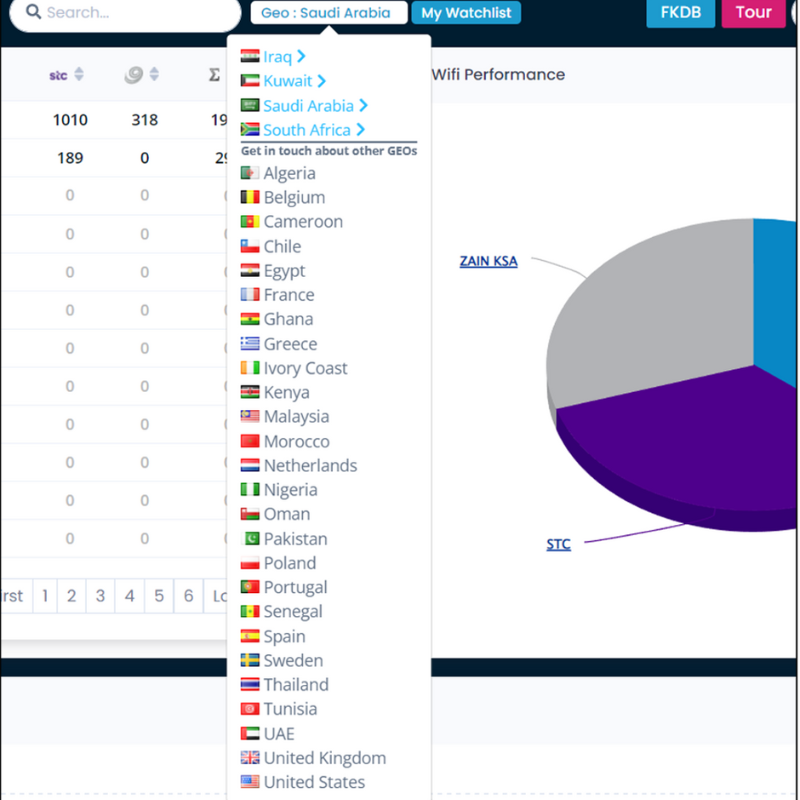

In recent years, the global carrier billing market has undergone significant shifts. Dawson points out that one of the most notable trends is how data analytics and business intelligence have become essential for informed decision-making. “Markets have generally done an excellent job of utilising big data and associated tools, which allow for more effective outcomes. A lot of merchants are now adopting a global approach, applying learnings from one territory to another far more easily than before,” he explains.

He’s also seen a shift in consumer value offerings, which have become more aligned with the convenience of DCB. In the past, there were often barriers around the perceived value of content. Now, as Dawson notes, “There are fantastic offerings that perfectly align with DCB, providing compelling propositions for consumers.”

Challenges in the Ecosystem

However, the path to sustainable growth is not without its challenges. For payment aggregators, one of the biggest hurdles is managing relationships with CSPs, MNOs, and regulators. “The whole value chain mindset needed to deliver sustainability in every market is an evolving challenge, especially for aggregators who must ‘please all parties’ to stay relevant,” Dawson observes. Aggregators need to constantly tweak and refine their processes, often based on key performance metrics, to ensure they are meeting expectations across the board.

Balancing the different demands of CSPs, MNOs, and regulators is no easy task. Dawson emphasises the importance of patience and education in this process. “You must be willing to educate various points of the value chain, many of which often have a one-dimensional view of the landscape. It’s about making strong commercial and operational decisions for the overall good of the wider market,” he says.

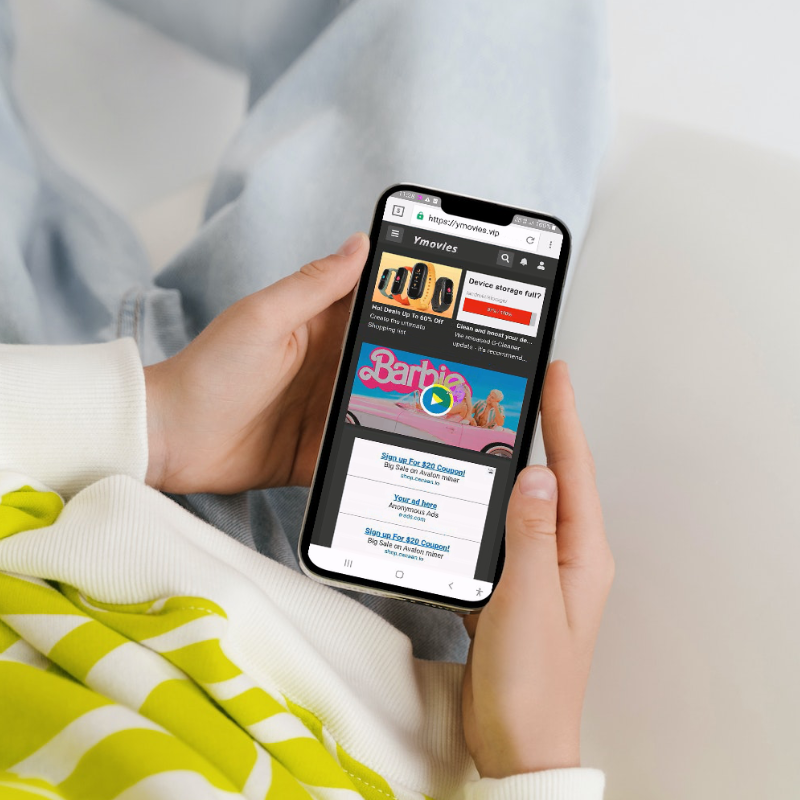

One area where aggregators often face difficulties is compliance. Merchants, being marketeers at heart, are always looking to gain a competitive edge. As a result, they sometimes push the boundaries of compliance, putting aggregators in a difficult position. “Aggregators wear multiple hats,” Dawson explains. “They have to ensure compliance with multiple codes of practice across carriers and regulators, manage pre-launch service checks, and validate in-life services while maintaining robust customer care levels.”

This is where trusted outsourcing partners come into play. “It’s a huge ask for aggregators to manage everything, especially with tight operating margins,” Dawson points out. “Many are turning to partners like MCP Insight for support, outsourcing crucial tasks like DDRC, compliance monitoring, and service onboarding and testing to free up their resources for growth.”

Growing Sustainable Carrier Billing Revenue

When it comes to driving sustainable growth, Dawson is clear: aggregators need to stay focused on what they do best. “I’ve seen various new forms of the aggregator role emerging, but what I can’t see value in is aggregators trying to serve multiple points in the value chain with clear conflicts of interest,” he asserts. In his view, aggregators need to maintain their integrity by focusing on their core role and not compromising in other areas.

Aggregators also play a key role in helping CSPs launch innovative services while ensuring compliance. Dawson explains that the true value of an aggregator lies in its 360-degree view of the marketplace. “Aggregators can do a lot more than simply accept or reject services based on a checklist. They can provide insights into carrier ‘value judgements’ on content genres, pricing, marketing channels, and service expectations. This data enables merchants to make informed decisions that align with compliance and consumer expectations,” he says.

Tools like MCP Insight’s compliance monitoring platforms and risk management solutions are critical in this process. “With the increasing demands placed on aggregators, they need to use third-party enablers like MCP to do the heavy lifting,” Dawson advises. By outsourcing tasks like DDRC, monitoring, and in-service testing, aggregators can focus on their strengths—attracting and retaining clients, and driving sustainable growth.

The Global Regulatory Landscape

Regulation is a key factor shaping the future of carrier billing worldwide. According to Dawson, global markets are moving at different paces, but they generally follow similar paths. “Today, most European markets demonstrate a clear structure and understanding of the practices needed to sustain a healthy DCB marketplace, much like the standards adhered to by more traditional payments mechanics such as card payments,” he notes.

In contrast, less developed markets, such as those in the Middle East and Africa, are still learning from these experiences. “These regions have faced challenges due to poorly managed or the lack of compliance standards, but they are now rapidly adopting robust frameworks, often with guidance from compliance houses like MCP and the experience of their European counterparts, to build sustainable markets,” Dawson explains.

For aggregators, entering new markets requires careful timing. “Emerging regions like South America and Asia present exciting opportunities, but entering at the right time is crucial to ensure a sustainable scope of opportunity,” he advises. Regulatory factors should be part of that decision-making process. Entering too early, without clear standards, can expose businesses to risks such as market shutdowns, while waiting too long may mean missing early opportunities.

Business and Brand Growth for Aggregators

Looking ahead, Dawson emphasises the importance of knowing your markets intimately. “Aggregators need to become trusted oracles of knowledge for their partners, offering a service-led approach that sets them apart from the competition,” he says. In a rapidly evolving industry, communication, transparency, and the ability to anticipate the needs of the value chain are key to building strong relationships with both CSPs and MNOs.

Dawson also sees the role of aggregators evolving over the next five years. As some larger merchants seek direct connections with carriers, aggregators will need to redefine their value proposition. “It’s about recognising where your value lies and focusing on excelling in that area. Once you know your value, it’s much easier to channel your efforts and thrive,” he asserts.

Looking Ahead

Dawson is optimistic about the future of carrier billing. “I have no doubt that the forecasts for significant, sustainable market growth will be realised,” he says. However, he also stresses the responsibility of all players in the industry to make smarter choices. “It’s up to us to embrace fair and level playing environments to ensure long-term success.”

For payment aggregators looking to build a sustainable, compliant, and profitable business, Dawson has one final piece of advice: “Speak to MCP Insight. Let us help you accelerate your business by taking on essential functions like DDRC, compliance monitoring, consent to charge, and payments security. Allow us to support your evolution as an aggregator, so you can focus on what you do best.”

Ready to drive sustainable carrier billing growth?

Get in touch with MCP Insight to learn how our expert services in compliance, risk management, and fraud prevention can help your business thrive in the evolving carrier billing landscape.