Direct Carrier Billing (DCB) has emerged as a robust alternative payment method over the last decade, its adoption has been rapidly increasing worldwide. With the growth of mobile phones and the internet, DCB has become a convenient and secure way for mobile users to pay for mobile value-added services (mVAS) without the need for traditional payment methods such as credit/debit cards or e-wallets. DCB is going mainstream.

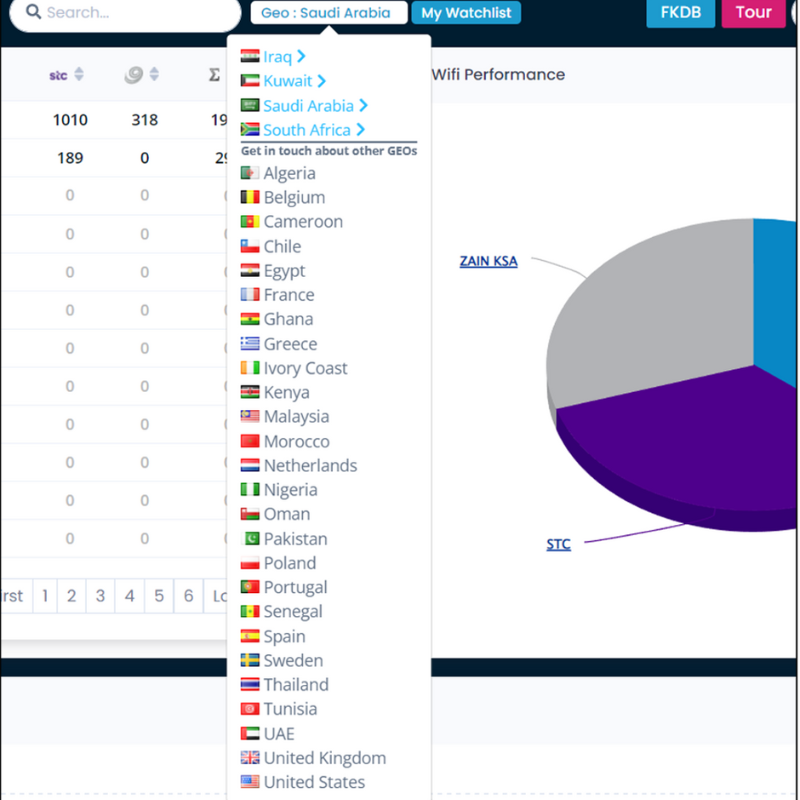

According to a report by Zion Market Research, the global DCB market was valued at around USD 23.5 billion in 2019 and is expected to reach approximately USD 172.8 billion by 2027, growing at a CAGR of around 29.7% between 2020 and 2027. The market’s growth is due to the increasing adoption of smartphones, the growing internet penetration rate, and the rising demand for digital content.

DCB: an increasingly popular payment method

One of the significant advantages of DCB is that it does not require any payment card or bank account information to make a transaction, making it an ideal payment method for customers who prefer not to share their financial information online. DCB is independent from the banking system. Instead, customers can make payments by simply adding the charge to their mobile phone bill or deducting the payment from their prepaid balance. This method provides an additional layer of security to users, as they only need to enter their mobile phone number to complete a transaction.

DCB is particularly popular among young people and those without access to traditional payment methods. According to a study by Juniper Research, DCB is expected to reach 11% of all digital payments by 2025, driven primarily by millennials and Gen Z consumers who are more likely to use mobile payments. In addition, the study found that over 2 billion people worldwide have no access to traditional banking services, highlighting the importance of alternative payment methods such as DCB.

DCB: not just for digital content

Another significant advantage of DCB is its simplicity and ease of use. The payment process is streamlined, with only a few clicks required to complete a transaction. As a result, DCB has become a popular payment method for purchasing digital content, such as music, games, and apps, where customers are looking for a quick and hassle-free payment experience. According to a report by Boku, a leading DCB provider, the gaming sector accounted for 70% of all DCB transactions in 2020, with music and video content making up the remaining 30%.

DCB’s convenience and ease of use have led to an increasing demand for the payment method to be used for other products and services. There’s a significant opportunity for retailers and service providers to offer DCB as a payment option for goods and services, such as transportation, food delivery, and online shopping. For example, Amazon customers in Japan can use their mobile phone bill to pay for physical goods, and in Texas USA, drivers can charge highway tolls to their mobile bill.

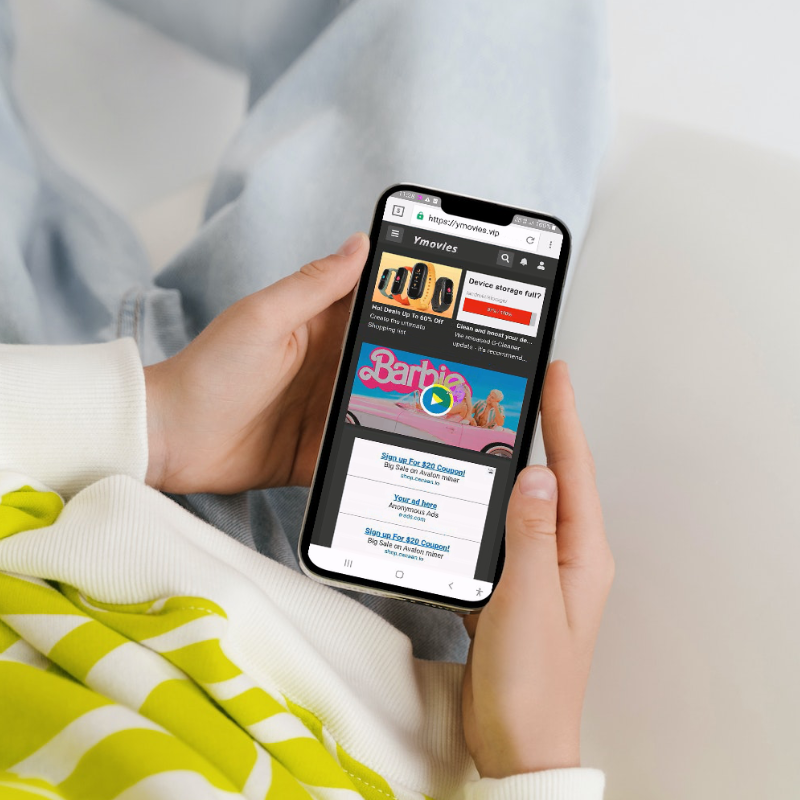

DCB: fraud concerns

As with any payment method, fraud is a concern with DCB. However, the risk of fraud with DCB is relatively low compared to traditional payment methods, as it does not require customers to enter sensitive payment information. To mitigate the risk of fraud, DCB providers use advanced fraud detection systems to monitor transactions and identify suspicious activity. Additionally, many DCB providers have implemented strict user verification processes, such as one-time passwords (OTPs) or biometric authentication, to ensure that only authorized users can make transactions. Overall, DCB’s security features make it a viable and secure payment method for consumers and merchants alike.

If you’re an aggregator or carrier exploring the DCB opportunity and would like to discuss how to minimise the risk of fraud, non-compliance and, most importantly, customer complaints, get in touch with our team. We have extensive expertise in helping organisations manage risk and grow revenue through DCB and would be delighted to share our experience and best practice with you.