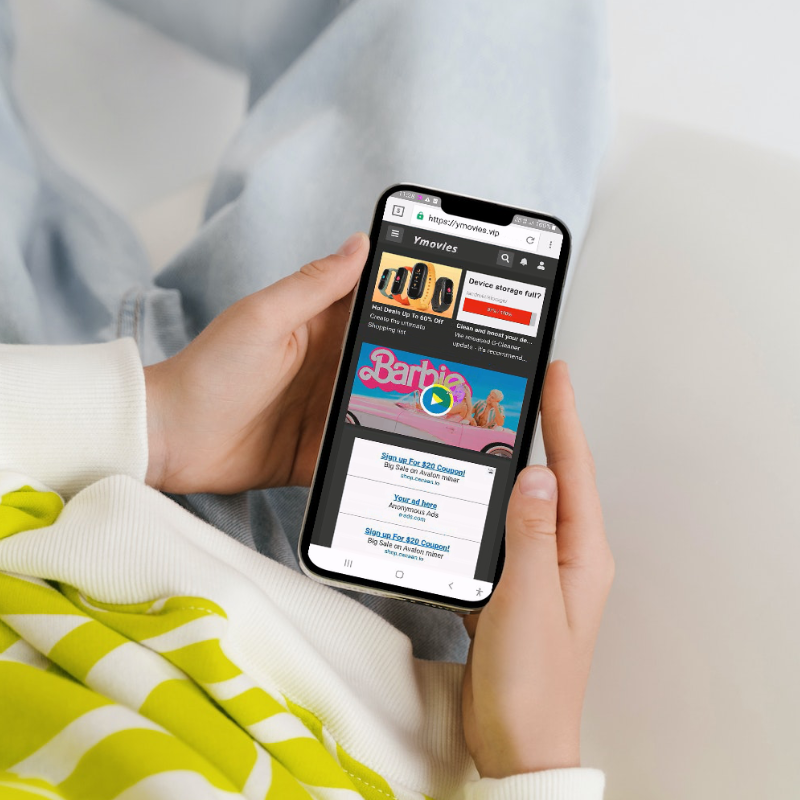

In its Annual Market Review 2021 – 2022 the Phone-paid Services Authority (PSA – UK phone billed content and services regulator), found that 31% of survey respondents said they have been charged for a service they hadn’t given consent for.

Many people would assume that these transactions are fraudulent, such as malware infected apps subscribing users to services without their knowledge. While there’s no denying that the global mobile carrier billing industry is vulnerable to fraud, not all complaints of this nature are linked to fraudulent activities. Instead, they are legitimate services that the end user may have forgotten they purchased, don’t recognise on their mobile bill, have buyer remorse, or a number of other reasons.

To our knowledge, PSA’s research is the only independent study undertaken to measure and fully understand why consumers complain about mobile billed services. While it is a UK survey, talking to our international clients, the reasons for complaints generally have global application. The 31% stat is even more surprising in the UK, where there is a high regulatory bar, which requires all transactions to evidence robust and informed ‘Consent to Charge’, by an independent party rather than the service provider.

Why do users think some genuine Mobile charges are suspicious?

There are four main reasons this happens:

- The bill descriptor isn’t clear. It may list the service provider or a number, but not a recognisable service or brand. Sometimes charges simply appear as ‘third party service’ on a bill.

- The charge doesn’t match customer expectations. The charge for the content or service may be split into increments (e.g. a £30 transaction may be billed in x3 £10 increments) or the customer did not realise they had signed up for a subscription service which can be billed on a daily, weekly or monthly basis.

- Unauthorised access to the mobile or sim. Family member access to a mobile phone – where the owner/bill payer hasn’t given permission to charge for a game or other service remains a common problem. The bill payer doesn’t recognise other household member’s charges to their account as they’re unaware of their activity, and the default reaction is to flag the charge as unrecognised.

- The customer has genuinely forgotten they subscribed to the service. It happens, a customer subscribes to a service, uses it for a few days and then forgets about it. They receive their mobile bill weeks later and query the charge, or don’t look and notice the charge months later.

How can mobile network operators (MNO) resolve this issue?

Although the service provider or merchant is ultimately responsible for complaints about its service, most customers will initially raise a complaint with the mobile operator because the MNO issued the bill. Complaints like these have an adverse impact on the mobile operator. They put additional pressure on customer service departments, have a negative impact on NPS scores and industry rankings, and can be damaging to the mobile operator brand.

However, some customers bypass the MNO and go straight to the regulator or the ombudsman and this can have regulatory implications. High volumes of complaints can lead to tighter regulations making it more challenging to operate in the market and eroding the bottom line for everyone.

Clearer bill descriptors

One seemingly easy solution is to ensure bill descriptors clearly state what the charge is for, using recognisable brand names or service descriptions, which are consistent with the service and check out experience. This has been proven to be an effective solution across the board in a comparable market – payment card transactions – with merchants seeing a reduction in chargebacks when bill descriptors accurately reflect the merchant and services provided.

For mobile billed services, many MNO bills and Apps now provide a good level of service descriptors/information. Some bill descriptors also include the customer care number for the service provider or merchant. However, certain MNO legacy billing platforms are limited to a specific number of characters, and therefore cannot always include full information. Furthermore, for many operators, updating bill descriptors cannot happen overnight. In fact, for some it can take several years to implement, while in the meantime the complaints continue. What is essential, is to have an agreed and efficient policy on descriptors in the space available.

6 other ways to reduce mobile billing complaints

As well as clear bill descriptors, there are other ways you can reduce mobile billing complaints and prevent them from escalating. We recommend exploring the following key areas:

1: Customer care

MCP Insight has been working with aimm and MEF to create best practice guides with the goal of reducing customer care escalations to mobile network operators. aimm’s Customer Care Best Practice Guide was published last year and we expect MEF’s later in 2022.

The focus of both guides is to make it easier for mobile customers to get support and have their complaint resolved quickly. From self-serve options such as FAQs about billing and charges, to creating a joined-up customer service infrastructure so MNOs can smoothly transfer customers to the relevant merchant’s customer service team, we think self-regulation by adopting these best practices will help the industry as a whole.

2: Mobile operator call centre staff training

All too often we hear that MNO call centre staff or MNO bulletin board/social media moderators pass out the wrong information about a charged service, or worse end up agreeing with an enquirer that it must be a ‘scam’. This leads to a nailed-on complaint.

Some MNOs have trained specialist teams to handle enquiries about content services charged to the phone bill. They provide accurate service information, understand vulnerabilities of certain callers and route enquiries efficiently to the contracted service provider to handle the enquiry or complaint. Follow up recourse measures are then implemented.

3: Service checker and MSISDN lookup tools

To create a joined-up customer service infrastructure, customer care teams at MNOs need access to all the information about the customer and the service provider/service for which the customer was billed. Service checkers and MSISDN lookup tools enable customer care operatives to find key information about the services the user has purchased or subscribed to, speeding up response and resolution times. To ensure the MNO care team has access to full service and care information, it is essential to have a robust partner accreditation process, service registration and onboarding approval system.

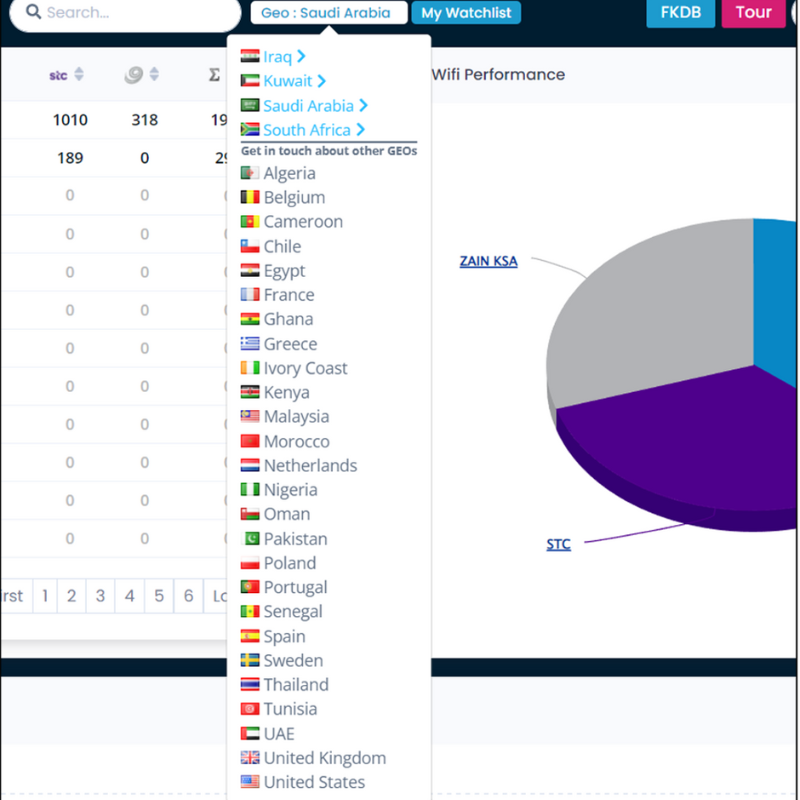

Third party service checkers

In some countries the regulator (eg UK) or trade association (eg Netherlands) have set up a service registration scheme where customers can look up a service name or billing identifier and find the merchant’s customer care contact details. Having one central platform enables a consistent approach to providing service information and one that can be promoted to customers by all parts of the value chain.

4: Third party verification of user consent

If a customer, or the regulator, wants evidence that they’ve signed up for a service, proof of user consent is needed. 3rd party verification tools meet regulatory compliance requirements and can also provide a full audit trail of the user’s journey, including purchase timestamps, a log of the terms and conditions and pricing at the time of the transaction, and for online transactions also landing/purchase page screengrabs and video of customer actions taken.

Have a look at MCP Verify to learn more about these services >

5: Visual reminder / recording

aimm’s customer care guidance recommends providing customers with a visual reminder of how and when they originally bought the service. It said, “One service provider showed that 80% of all consumers recalled making the purchase when they were shown an exact copy of the promotion, along with copies of the service messages sent to their handset (with time and dates stamps) allowing the customer service ticket to be closed immediately.”

Tools like MCP Verify record screenshots of each session so operators and merchants have visual evidence of the transaction.

6: Transparent messaging

Regulators publish Transparency Standards so that consumers can make fully informed decisions before any charge is incurred. Transparent messaging also protects MNOs and merchants from complaints and regulatory disputes.

Generally, regulators require the following information to be provided to the customer: pricing information, frequency of charges, confirmation that charges are added to the bill, provider details and service name. We recommend that additionally, if the bill descriptor does not reflect the provider and service name, the customer is also informed of what the charge will look like on their mobile bill.

For example, “Charges for this service will be added to your mobile phone bill and will be listed as [insert bill descriptor].”

How we can help you reduce mobile billing complaints

MCP Insight partners with MNO, Mobile Aggregators and Service Providers to monitor services for fraud and compliance, but a big part of our role is to advise on how to limit complaints and ensure customer satisfaction remains high.