MCP Insight, a leading provider of Anti-Fraud and Compliance solutions, and Sam Media, just celebrated 3 years of working together by agreeing to continue our compliance partnership.

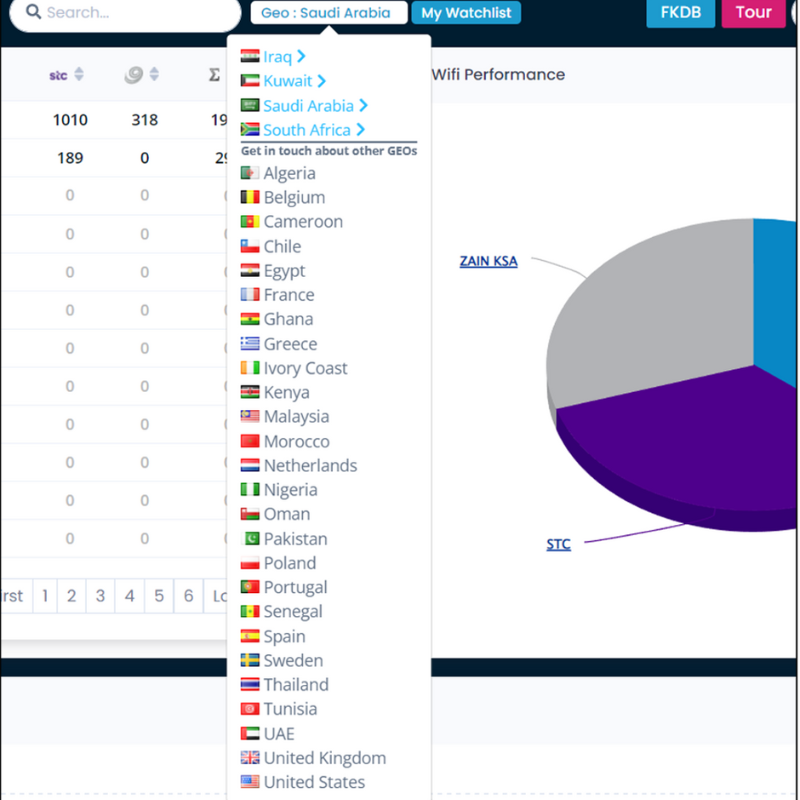

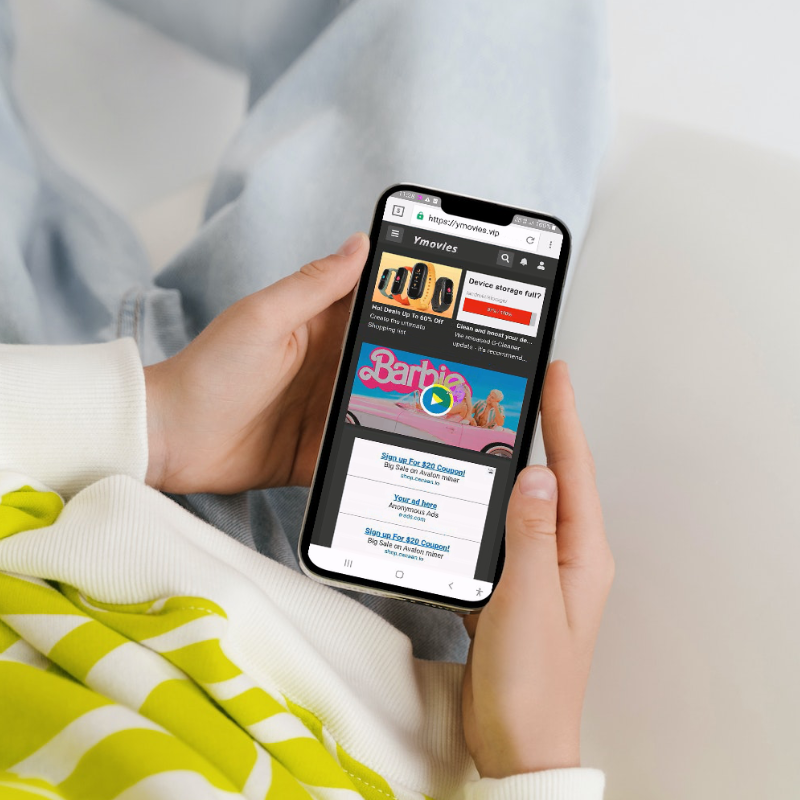

Sam Media uses MCP’s advertising and compliance monitoring technology, MCP Scanner, to help protect their business from non-compliant promotions and provide access to in-depth market intelligence and trends, including competitor flows. Sam Media have now rolled out the MCP Scanner service in over 15 different GEOs.

To find out more about our product, MCP Scanner get in touch via our Enquiries Page

MCP Insight is a UK based compliance and fraud monitoring company, specialising in mobile gateway traffic. Our clients include Mobile Operators, Regulators, Aggregators and Merchants. We’ve been providing solutions to the mobile payments industry across 30 territories for the past six years.