MCP Insight, which specialises in anti-fraud and compliance systems, has made significant upgrades to its market intelligence tool, MCP Scanner (now version 3.0). This will be available to clients from 28th February, 2022.

Scanner has underpinned MCP’s expansion to 30 countries, supporting mobile content partners and mobile operators with key market intel and compliance monitoring.

We have listened to client needs and worked closely with them over the past 6 months to understand what new product features should be added to Scanner. These new features will help clients grow their business, by having fast access to key market analysis and compliance support.

Toby Padgham, Director MCP Insight

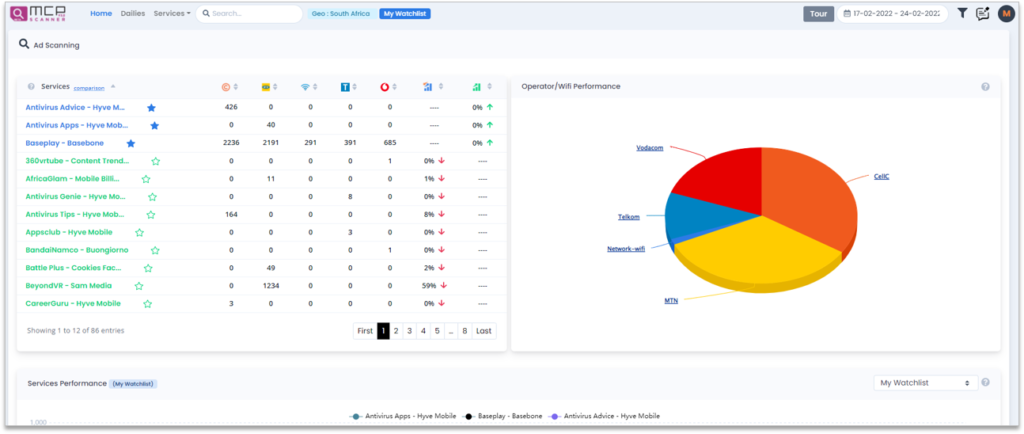

Scanner 3.0 adds significant new functionality, including:

- New & Improved UI With Microservices Deployed to speed up the usage and interactive loading

- Comparative analysis between your Brands, Competitor Watchlist and Rest of Industry

- Performance/Market Share Metrics

- Brand Category Analysis

- Super Filters by MNO, Aggregator, Merchant, Category, Payment Types

- Quarterly/Monthly/Weekly or Custom Range comparison between Brands

- Brand Advertising Channel Analysis

- New Brand Discoveries, Consistent/Periodic

- New Facebook scanning engine

- Full end-to-end tests showing payment flows

… And much, much more