Welcome to our comprehensive glossary of terminology for the mobile payments industry. In today’s fast-paced digital world, mobile payments have become an increasingly popular way to make transactions quickly and securely. However, it can be challenging to keep up with the industry’s ever-evolving terminology.

That’s why we’ve compiled this A to Z glossary, which provides definitions of the key terms and concepts you need to know to navigate the mobile payments landscape. Whether you’re a mobile operator, content service provider, merchant or simply curious about the latest developments in mobile payments, our mobile payments terminology glossary is the ultimate reference guide to help you stay up-to-date with industry jargon.

Mobile payments terminology

2 Factor Authentication (2FA): An extra layer of security to protect your accounts from identity theft and fraud (other than your basic log-in credential). An example is One Time Password (OTP). Also known as Multifactor Authentication (MFA) where users need to present at least two forms of identification – if not more.

Affiliate: An affiliate is a third-party entity that promotes digital content, such as mobile apps or games, and receives a commission for every successful purchase made through the carrier billing payment method. Affiliates can be mobile content publishers, app developers, or digital marketing agencies.

Accredited Payment Intermediary (API): An accredited payment intermediary is a financial institution that has been authorised by a regulatory body to act as an intermediary between two or more parties involved in a payment transaction. This intermediary facilitates the payment process by verifying the transaction details, processing the payment, and transferring the funds from the payer to the payee.See also Aggregator.

Aggregator: A company that aggregates payments from multiple sources and provides them to merchants or other businesses.

Alternative Payment Methods (APMs): Refer to any payment method other than traditional cash or card payments. They include a range of digital payment options that have gained popularity in recent years, including eWallets, bank transfers, cryptocurrencies, mobile payments, prepaid cards and online payment systems.

API: Not to be confused with Accredited Payment Intermediary, with the same abbreviation, API stands for Application Programming Interface, which is software that enables the connection between two applications. Such as a mobile payment landing page and an anti-fraud solution.

Anti-Money Laundering (AML): A set of laws and regulations aimed at preventing the use of financial systems for illegal activities, such as money laundering or terrorist financing.

Charge-To-Bill (CTB): Charge-to-bill is a mobile payment method that allows users to make purchases or payments by adding the charge to their monthly mobile phone bill. With charge-to-bill, users do not need to provide credit card or bank account information to complete a transaction. Instead, the amount charged is added to the user’s mobile phone bill, which they can pay at the end of the billing cycle. It is also known as Direct Carrier Billing (DCB), see below.

Compliance: Compliance refers to adhering to regulatory guidelines and standards in the telecoms industry, such as consumer protection laws and anti-money laundering regulations. Regulations vary between different countries and jurisdictions.

Consent Verification: Authentication of the user’s consent to opt into/purchase a service and the recording of the user journey.

Content Locking: This is a marketing technique used in mobile ad campaigns where a user is required to perform a certain action or provide personal information before accessing premium content, such as an exclusive video or article. Content locking can be seen as an intrusive or deceptive practice if the requirements are not clearly stated or if the content is not of sufficient value to justify the action.

Content Service Provider (CSP): A company that provides digital content, such as music or video, that can be purchased using mobile payments.

Conversion Rate: This refers to the percentage of users who complete a desired action, such as subscribing to an offer or completing a transaction. For example, if 100 users visit a landing page promoting a subscription service and 10 of them subscribe, the conversion rate would be 10%.

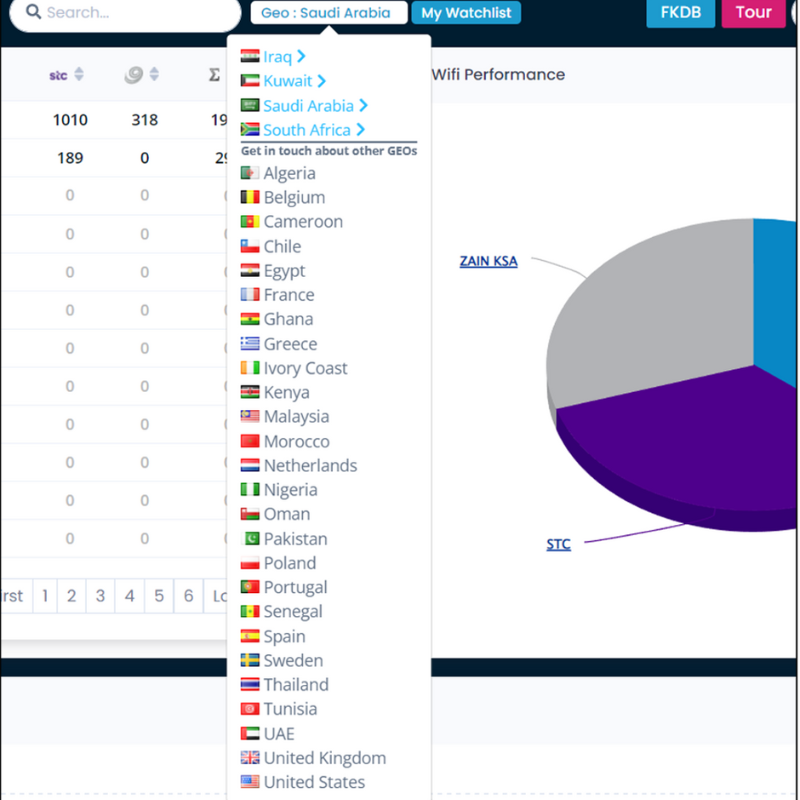

Cross-border Payments: Cross-border payments refer to financial transactions that involve parties located in two different countries or jurisdictions. To simplify these transactions and allow merchants to expand their business internationally without the need for physical presence in another country, Alternative Payment Methods (APMs) play a key role.

Direct Carrier Billing (DCB): DCB is an online mobile payment method that enables customers to buy goods and services by charging payments to their telecom operator carrier bill.

Due Diligence: The investigation or exercise of care that a reasonable business or person is normally expected to take before entering into an agreement or contract with another party or an act with a certain standard of care.

Due Diligence, Risk Assessment and Control (DDRAC): DDRAC is mainly focused on initial pre-contract checks, whilst Risk Control is focused on ongoing monitoring checks. See also Risk Control.

Embedded Payments: These refer to the integration of payment capabilities directly into other digital products or services, such as mobile apps, websites or social media platforms. This allows users to make payments without having to leave the application or website they are using, creating a more seamless and convenient experience. Embedded payments are becoming increasingly popular in the mobile payments space, providing a smooth checkout process to users.

eMoney: eMoney is short for electronic money, which is stored in the accounts of users, agents and mobile money service providers.

eWallet: An eWallet is a digital account accessible through a mobile phone, via an app. Users can pay or transfer electronic money without the need for a bank account.

Fraud: In the context of the mobile payment space types of fraud include:

- Bots – spam traffic. Bots can be programmed to mimic human behaviour and interact with mobile payment platforms in a way that can bypass security measures or exploit vulnerabilities.

- Browser exploits – XSS vulnerabilities to click/navigate to payment page without user’s consent.

- Click jacking – unknowingly click on hidden payment page/link

- JS injection – malicious code is injected to perform actions without the user’s consent

- Malware – short for malicious software, refers to any software specifically designed to harm or exploit mobile devices, including mobile apps.

- Phishing – the fraudulent practice of sending emails or other messages purporting to be from reputable companies in order to induce individuals to reveal personal information, such as passwords and credit card numbers

- Smishing – the fraudulent practice of sending text messages purporting to be from reputable companies in order to induce individuals to reveal personal information, such as passwords or credit card numbers.

- Spoofing – mimics real device behaviour to deceive users or gain unauthorized access to mobile apps or their data.

- Tab nabbing – where a new browser window or tab opens in the background redirected to a malicious website.

- Touch jacking – this is where an attacker overlays or hijacks the user interface of a legitimate app with a malicious layer, tricking the user into interacting with the malicious layer instead of the legitimate app.

- Vishing – the fraudulent practice of making phone calls or leaving voice messages purporting to be from reputable companies in order to induce individuals to reveal personal information, such as bank details and credit card numbers.

Fraud Prevention: Fraud prevention measures are used in mobile payments to minimise the risk of fraudulent transactions. They include measures like IP blocking and device fingerprinting and fraudulent anomaly detection tools like MCP SHIELD.

In-App Purchases: In-app purchases are a type of value-added service (VAS) in which users can buy digital goods or services within a mobile application using their mobile payment account.

Know Your Customer (KYC): A regulatory requirement that requires businesses to verify the identity of their customers to prevent money laundering or other illegal activities.

Merchant Payment: This is a payment made from a mobile wallet or mobile money platform to a retail merchant in exchange for goods or services, including both digital and physical goods.

Micropayments: These are small transactions generally made online to pay for goods or services, such as a mobile game download or monthly subscription to a Video On Demand (VOD) platform.

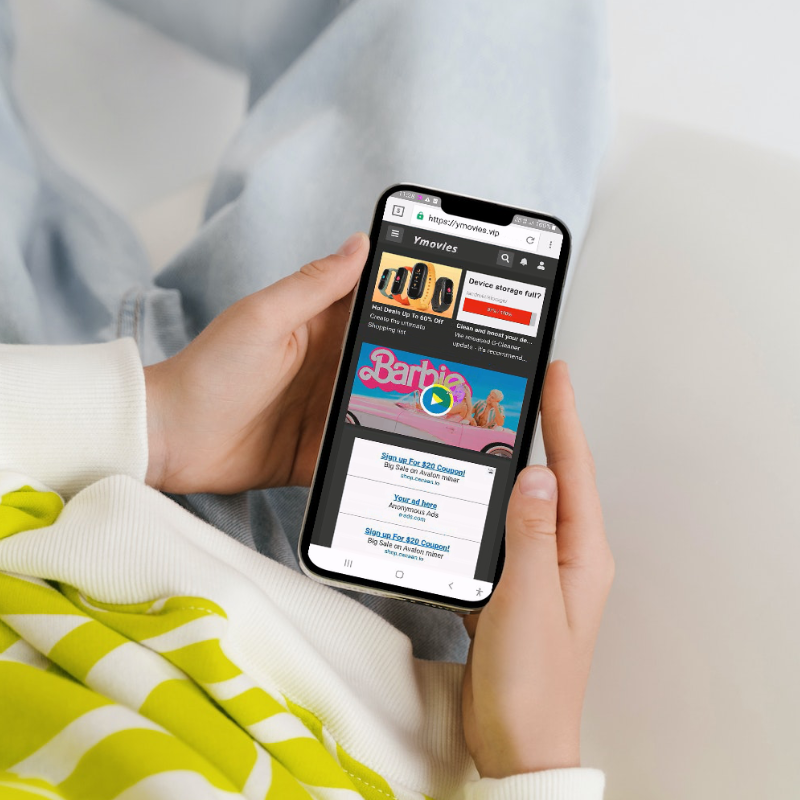

Misleading Ad: This is an advertisement that is deceptive or misleading in its content, presentation or representation of products or services related to DCB or VAS. Examples include:

- False or exaggerated claims – Ads that make false or exaggerated claims about the features, benefits, or pricing.

- Hidden charges or fees – Ads that do not clearly disclose all the charges or fees associated with the service, leading users to believe that a product or service is free or low-cost.

- Misrepresentation of products or services – Ads that misrepresent the nature, quality or functionality of the service. For example, an ad may depict a VAS service as a legitimate mobile app when it is actually a scam or malware.

- False endorsements or testimonials: Ads that use fake endorsements, testimonials or reviews, misleading users into thinking that a product or service is endorsed by reputable sources or has positive feedback when it does not.

- Confusing or unclear information: Ads that present information in a confusing or unclear manner, making it difficult for users to understand the terms, conditions or implications of a purchase or subscription.

Mobile Advertising: Mobile advertising is a form of VAS where ads are displayed on mobile devices. Users can interact with the ads and be directed to pay for products or services through their mobile billing account.

Mobile Ad Fraud: This refers to fraudulent activities in mobile advertising campaigns, such as falsely representing the number of clicks or views on an ad or using automated bots to simulate user engagement. Mobile ad fraud can result in wasted advertising budgets, decreased ROI, and a loss of trust between media agenices, affiliates and content service providers.

Mobile Money: A service that allows users to transfer money, pay bills, and make purchases using their mobile device.

Mobile Network Operator (MNO): A company that provides mobile network services to customers, including the infrastructure necessary for mobile payments.

Mobile Payment: A payment made using a mobile device, which can include a smartphone, tablet or wearable device.

Mobile Wallet: A digital wallet, eWallet, that stores payment information and allows users to make payments through their mobile device.

mVAS: Stands for Mobile Value-Added Services, such as mobile content, gaming, music, film and other services mobile users can purchase on their phone. See also VAS.

Near Field Communication (NFC): A technology that enables two devices to communicate wirelessly when they are in close proximity to each other.

Payment Service Provider (PSP): A company that provides payment processing services to merchants or other businesses.

Premium Rate Service (PRS): PRS refers to any service that is billed at a premium rate, typically higher than the standard rate, such as for entertainment or information services.

Premium SMS: Premium SMS is a messaging service that allows users to send and receive SMS messages for VAS at a premium rate, typically higher than the standard rate. It provides brands with the ability to generate revenue from the Premium SMS based on a revenue share deal with the mobile operator.

QR Code: A two-dimensional barcode that can be scanned by a smartphone to access information, including payment information.

Payment Gateway: A service that connects a merchant’s website or mobile app to the payment processing network.

Payment Hub: A payment hub is a platform through which payments are transacted, enabling different payment methods. In the context of mobile payments, merchants can connect to carriers and mobile money providers to facilitate secure and quick payments through DCB, eWallets or other alternative payment methods.

PIN Verification: A PIN verification is an added layer of security in DCB where customers are required to enter a PIN to confirm a payment.

Refund: A refund is a request by a customer to their mobile carrier to reverse a payment made through DCB.

Risk Control: Part of the risk management process in which methods for neutralising or the reduction of identified risks are implemented. Controlled risks remain potential threats, but the probability of an associated incident or the consequences thereof have been significantly reduced.

Secure Element (SE): A tamper-resistant hardware component that stores sensitive information, such as payment credentials, on a mobile device.

Short Code: A short code is a shortened phone number used for sending and receiving SMS messages. They are often used for VAS such as mobile payments, SMS-based contests or polling, and more.

SMS Verification: SMS verification is a security feature in DCB where customers receive a text message containing a code that they need to enter to confirm a payment.

Subscription Services: Subscription services are a type of VAS where users can subscribe to receive regular content, services or updates for a fee, which is billed through their mobile payment account usually on a monthly basis.

Third Part Pin Provider: The use of an independent bulk messaging provider to deliver text messages that contain data related to, for instance, marketing and/or security.

Tokenisation: A security measure that replaces sensitive payment information with a unique identifier, or token, to protect the data from theft or fraud.

Transaction Flow: In DCB a transaction flow typically starts from a customer initiating a payment on a merchant’s website or application, which is then passed through the aggregator, and finally billed to the customer’s mobile carrier account.

Unbanked: The term unbanked refers to individuals or households who do not have access to traditional banking services such as savings or checking accounts, loans, or credit cards. These individuals often rely on cash transactions or alternative financial services such as prepaid debit cards, money orders, or mobile money services for their financial needs.

USSD: Unstructured Supplementary Service Data (USSD) is a technology used by mobile network operators to send text messages between a mobile phone and an application server in real-time. It is often used for mobile banking and making payments.

Value-Added Services (VAS): In the context of mobile payments, VAS refers to any additional service or feature offered to customers beyond the standard voice, text, and data services provided by a mobile operator. VAS can include services such as mobile content, games, music, and other digital services that customers can purchase using their mobile phone and charge to their mobile bill or mobile wallet.