The carrier billing market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 29.7% between 2020 and 2027. However, as carrier billing transactions increase, so does the risk of DCB payment fraud. Fraudulent activities lead to a negative impact on your mobile carrier business – with customer complaints, damage to brand reputation and potential regulator involvement causing the most concern.

In this article we look at types of mobile payment fraud, the key features and functions a carrier billing fraud solution should provide, and how cost-effective solutions exist to help you grow sustainable revenue from carrier billing.

DCB payment fraud methods

Here is a snapshot of the mobile payment fraud threat landscape to help you understand the risks.

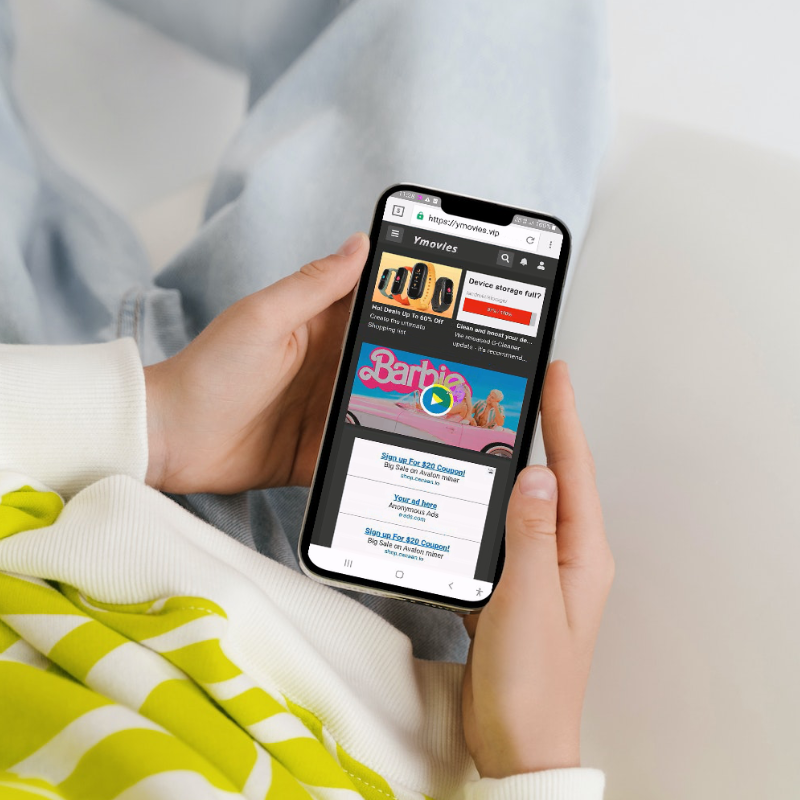

- APK fraud: This involves modifying a legitimate app and distributing it to customers to steal their information.

- Bypassing payment pages: This attack involves redirecting customers to a fake payment page that steals their information.

- Clickjacking: This tricks customers into clicking on a hidden button or link that performs a fraudulent action.

- Code injection: Cybercriminals add malicious code to legitimate websites to steal customer information.

- Malicious apps: Fraudsters create fake apps that mimic legitimate ones to steal customer information.

- Remotely controlled fraud: Cybercriminals use remote access tools to control a customer’s device and carry out fraudulent activities.

- Replay attacks: This involves intercepting a legitimate transaction and replaying it to carry out fraudulent activities.

- Spoofing: This type of fraud involves creating a fake website or app that looks similar to a legitimate one to steal customer information.

Identifying the right anti-fraud solution is crucial to protect your customers from mobile payment fraud. But they can be expensive. Many mobile carriers face various challenges in managing their operating expenditures, including rising infrastructure costs, increased competition and regulatory pressures. Therefore, it can be difficult to invest in expensive fraud protection solutions.

Of course, fraud costs mobile carriers money too. Although this may not be as easy to quantify as the cost of procuring a fraud solution. Lost revenue from carrier billing, the cost of managing the complaints process and refunds, and customer attrition all add up and, in some cases, deter mobile carriers from pursuing carrier billing revenue streams.

However, cost-effective carrier billing anti-fraud solutions do exist and can help you address the issue of fraud and protect your customers without breaking the bank.

Key features and functions of best-in-class carrier billing anti-fraud solutions

Look for solutions that:

- Detect unexpected changes and actions: Solutions that scan behaviours on payment pages and compare them to fraud patterns.

- Identify whether traffic is a bot: Tools that can detect whether traffic is coming from a bot or a legitimate customer. Bots can be used to carry out various types of fraud so detecting them is crucial to protecting customers from fraudulent activities.

- Block fraudulent attempts: Carrier billing fraud protection solutions should be able to block fraudulent attempts automatically. This can help prevent unauthorised access to customer information and stop fraudulent activities in their tracks.

- Allow you to decide what to block: Some solutions, like MCP SHIELD, have duel mode functionality that allows carriers to decide which transactions to block, and which to allow.

- Utilise reverse engineering: A reliable way to determine if a fraud solution is designed to protect against both known and unknown threats is when the technology provider incorporates reverse engineering to gain a deeper understanding of how cybercriminals operate. This allows the solution to stay ahead of emerging threats and provides better protection against fraudulent activities.

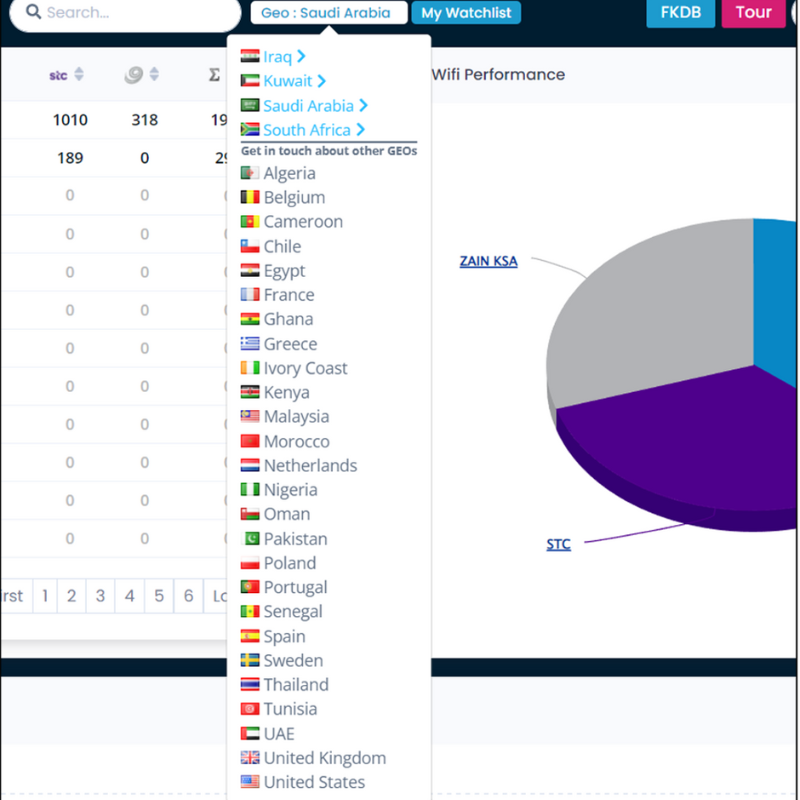

- Offer flexible pricing options: Most providers offer monthly pricing models, but also look for flexible options that allow you to only pay for the services that you use. For example, based on the number of geos, the number of queries and/or different tiers of service.

By implementing effective fraud protection solutions, mobile carriers can protect their customers from mobile payment fraud and build trust in carrier billing as a payment method. This can lead to increased revenue from carrier billing while at the same time reducing complaints and refunds.

How MCP can help you combat DCB payment fraud

Our carrier billing anti-fraud solution, MCP SHIELD, offers all the functionality and features mobile carriers need to monitor and protect payment pages hosted on your network and protect your customers. Compared to many of the solutions on the market, MCP SHIELD is significantly more cost-effective, ensuring that your business is protected without eroding limited budgets.

MCP SHIELD is secure, easy to deploy and utilises cutting-edge technology and the latest cyber threat intelligence, we’ve simply made it more affordable than many of our competitors’ products. That’s because we focus on helping you grow sustainable revenue from carrier billing, and partnering with you long-term.

To discuss mobile payment fraud and carrier billing or to learn more about MCP SHIELD please contact us or you can book a demo here: https://mcpinsight.com/book-a-demo/